Investment spending formula

Posted in April 2022 the tables represent a historic investment of more than 20 billion to transit agencies and communities to support public transportation throughout the country thanks to the Bipartisan Infrastructure Law. Its calculated by dividing the ROI by the number of years the investment is held.

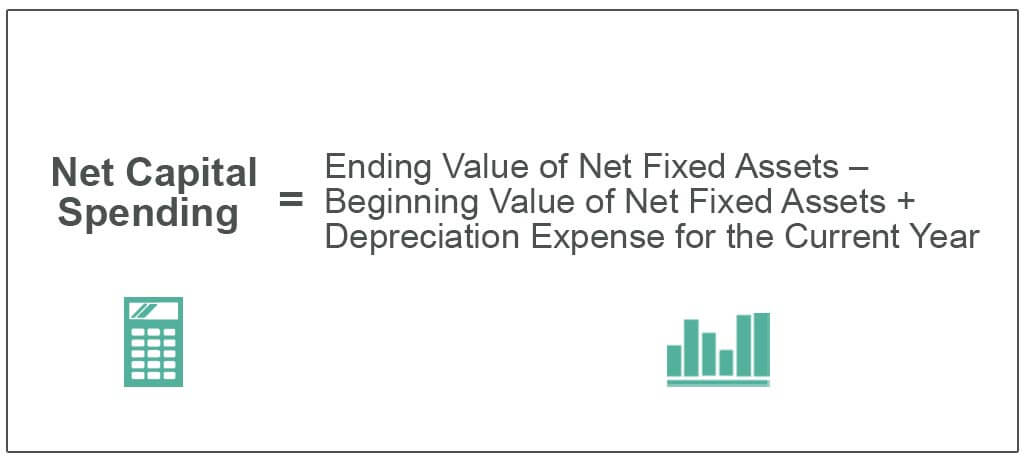

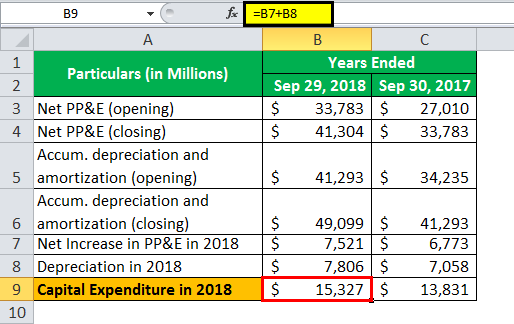

Net Capital Spending Formula Example How To Calculate

FTAs Fiscal Year 2022 full-year funding tables detail support for transit throughout the US.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

. Allows the reader to calculate the present-day value of an investment based on inflation-adjusted projections of its future earnings. That is economic law 101. Allies make direct and indirect contributions to the costs of running NATO and implementing its policies and activities.

Once returns exceed the original initial investment it counts as a capital gain and is therefore taxable. In the table above we can see. There is no such.

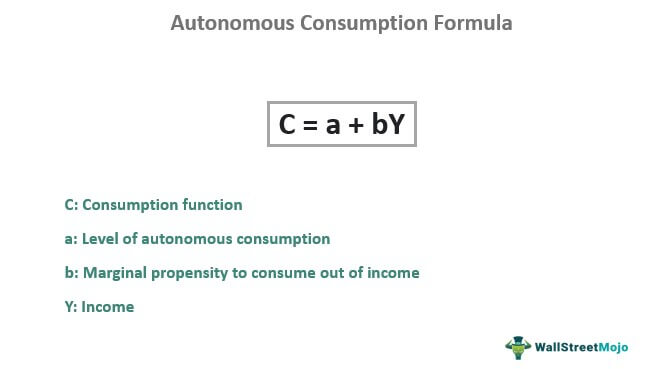

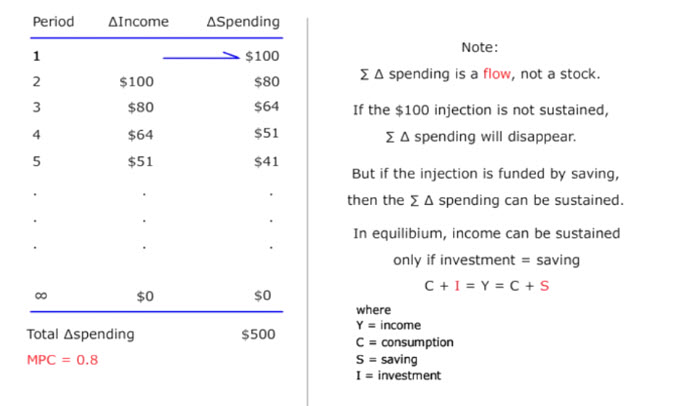

Let us now take the example of a nation where personal spending declined by 150 due to the increase in taxation that resulted in an average decline in disposable income of 350. 920000 850000 100000 170000. Here again the investment of 600000 would bring a change in the real GDP by 6000000.

From the top The act allocates an estimated 12 trillion in total funding over ten years including 550 billion in new spending during the next five divided between improving the surface-transportation network 284 billion and societys core infrastructure 266 billion. And the multiplier is calculated as 10. Suggest the tax policy which is required to achieve the desired GDP.

Indias govt revenuesGDP ratio for its level of per capita income is all right. NATO common-funded budgets and programmes are funded by direct contributions and equate to only 03 of total Allied defence spending an equivalent of around EUR 25 billion to run the entirety of the Organization its commands and. Thus the Net capital spending of the company for the accounting year 2018 is 170000.

In finance the purpose of investing is to generate a return from the invested asset. For example if a capital budgeting project requires an initial cash outlay of 1. Return on Marketing Investment Formula.

Measures the return an investment generates in a single year. It forces practitioners to define what the success. Return on Assets ROA.

Payback Period. By using CAC a company is able to determine the most cost-effective way to acquire customers. Net Present Value NPV.

Return of capital is a non-taxable event for the investor as long as the capital returned doesnt exceed the initial investment. The return may consist of a gain profit or a loss realized from the sale of a property or an investment unrealized capital. Understanding the cost to acquire new customers is crucial to analyzing marketing return on investment.

Investment requires a sacrifice of some present asset such as time money or effort. Also Calculate the increase in GDP if the government reduces the. This acronym corresponds with a formula calculating projects potential value from a different perspective.

Because its money being returned and not earned its not considered taxable income. As it sometimes might be difficult to track revenue its more convenient to approximate it by using the following. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments.

We got the following data for the calculation of the multiplier effect. For example consider a company that uses several channels to acquire customers. First interest rates rise affecting the drivers of the US economy housing but before that auto production goes from bull to a bear markets.

If a practitioner can define the present Time Volume and Dollars needed to complete the process the projects value can be derived. Its the govt expenditure that is the problem. The payback period calculates the length of time required to recoup the original investment.

Return on Marketing Investment ROMI Revenue generated by marketing effort - Cost of marketing effort x 100 Revenue generated by marketing effort While it is a simple formula its almost too simple. This impacts many other industries and the jobs report. Investment is the dedication of an asset to attain an increase in value over a period of time.

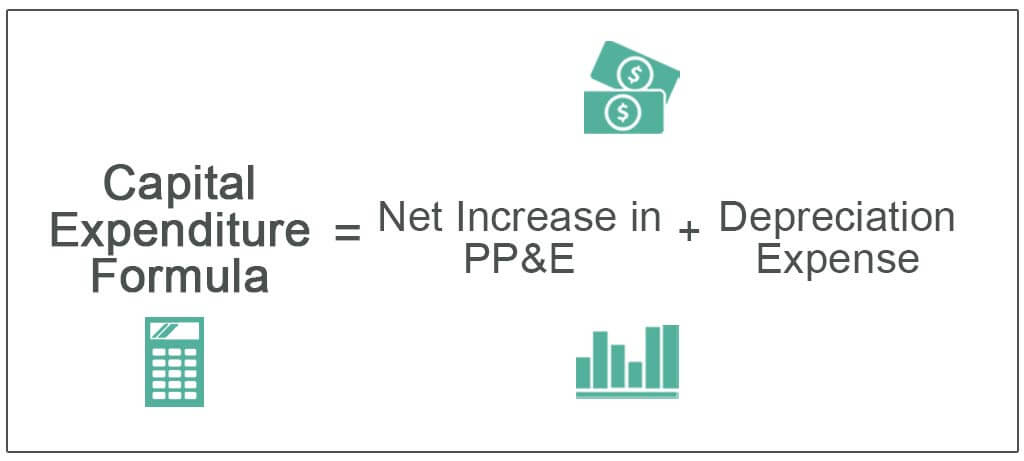

The value of the net capital expenditure Capital Expenditure Capex or Capital Expenditure is the expense of the companys total purchases of assets during a given period determined by adding the net increase in factory property. Multiplier Formula Example 2. Tax Multiplier Formula Example 1.

Now the government has decided to take steps to increase the GDP by 250 million in the current year. Let us take the example of a nation where the personal spending per capita increased by 500 as the disposable income increased by 650. Improving return on investment.

Return On Investment - ROI. States may also use categorical funding assigning dollars specifically for certain programs or. Calculate the fiscal multiplier based on the given information.

For example many states weight students when running their formula assigning more weight and therefore more dollars to students from low-income backgrounds or to students with special needs when calculating the amount of funding guaranteed by the state. An economy is either rising at a rising rate or business activity is falling at an increasing rate. When trying to quantify the value piece of the ROI formula remember the acronym TVD.

Here we break down BIL spending in four exhibits. ROI measures the amount of.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

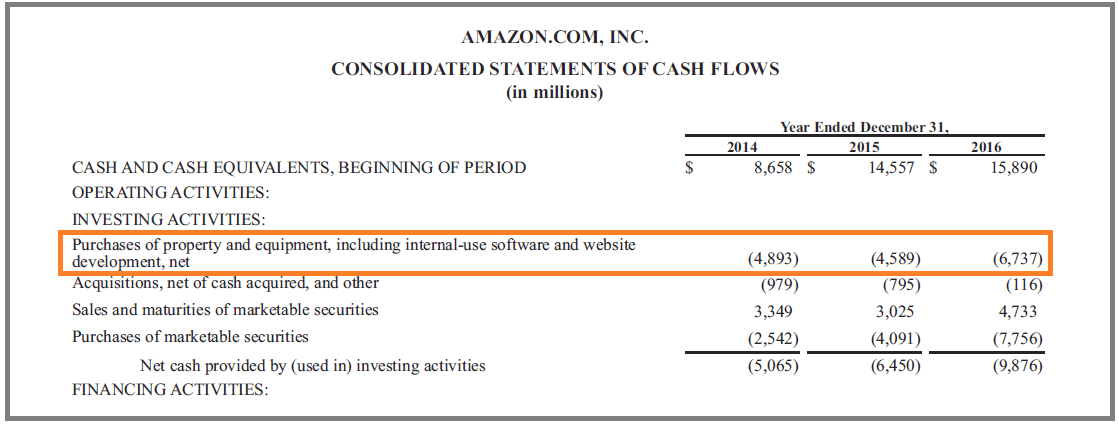

Cash Flow From Investing Activities Definition

/BankLoandBizInv2008-d55dca8fadfd42c1b202e1e519d3f886.jpg)

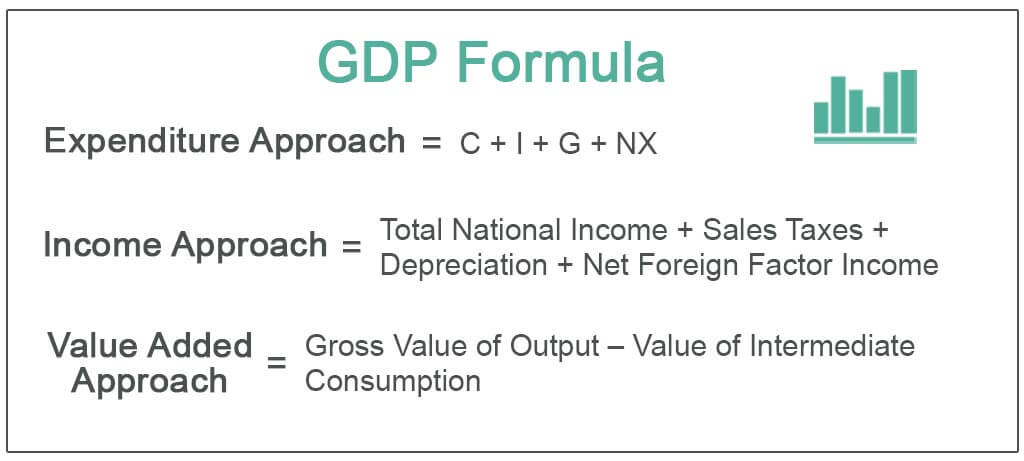

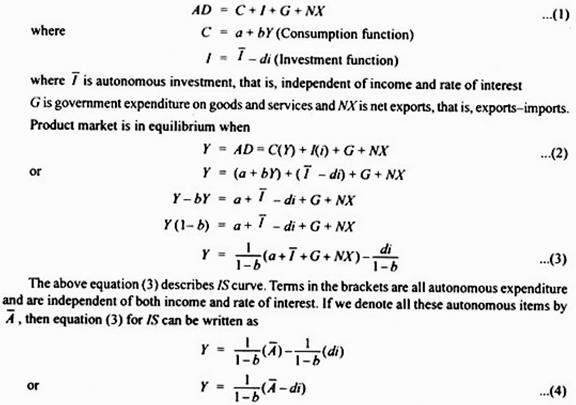

Aggregate Demand Formula Components And Limitations

What Are The Four Components Of Gdp Quora

Autonomous Consumption Definition Formula Example

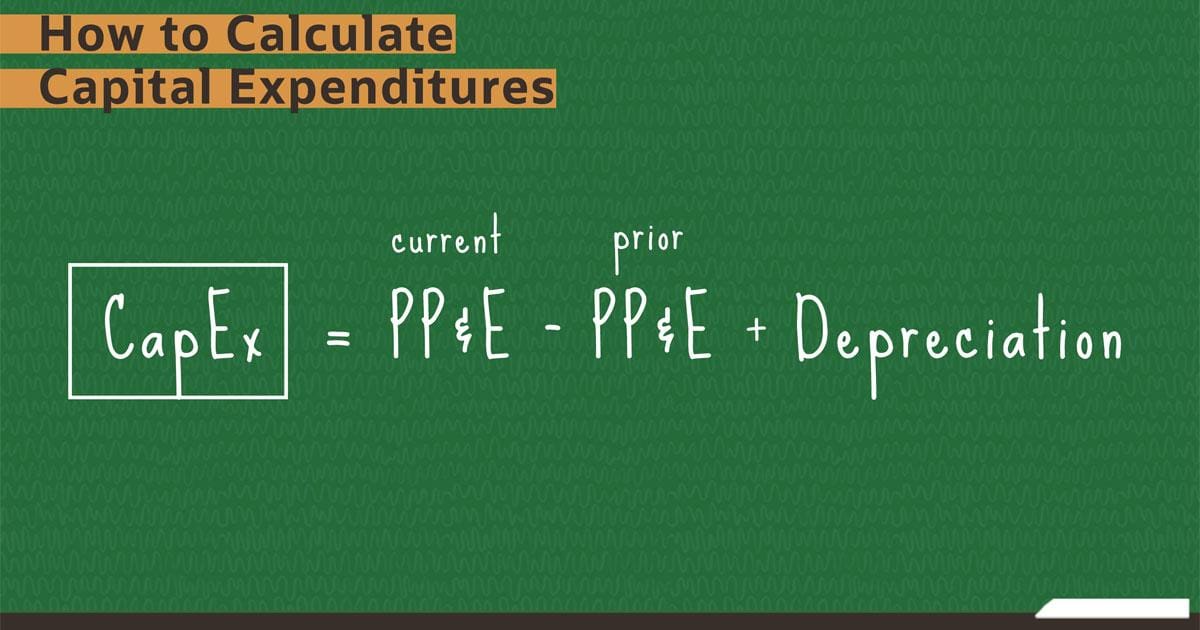

Capital Expenditure Capex Guide Examples Of Capital Investment

What Are Capital Expenditures Capex Why Are They Important Netsuite

Calculate Autonomous Consumption Expenditure From The Following Data About An Economy Which Youtube

Capital Expenditure Formula Step By Step Capex Calculation

Gdp Formula How To Calculate Gdp Using 3 Formulas

Living Economics Spending Multiplier Transcript

Algebraic Analysis Of Is Lm Model With Numerical Problems

Capital Expenditure Formula Step By Step Capex Calculation

Expenditure Approach For Gdp Definition Formula

Investment Spending Definition Formula Video Lesson Transcript Study Com

National Savings And Investment Video Khan Academy

Marginal Propensity To Consume Formula Calculator Excel Template

Capital Expenditures Capex Formula And Calculator Excel Template